How To Report Dog Walking Income . Like most tax answers, it depends. So you need to keep your own good. The owners will file taxes annually, no matter what—but. Being able to save money at tax time because you hang out with dogs all day! If you’re a dog walker for a company like rover or barkly pets, here are 11 deductible expenses you should keep track of throughout the. An accounting expert points out that income americans previously thought was invisible to the irs will now be tallied up and reported by venmo and similar apps. So how to report dog walking income? So sit and stay for a moment, because there’s a ton of expenses you. Dog walker and sitter tax deductions. It is not necessary to file a 1099 tax if you have earned less than $400, however, you are still. Accompanying form 1040, schedule c is essential for reporting your business income and deductible expenses related to your dog.

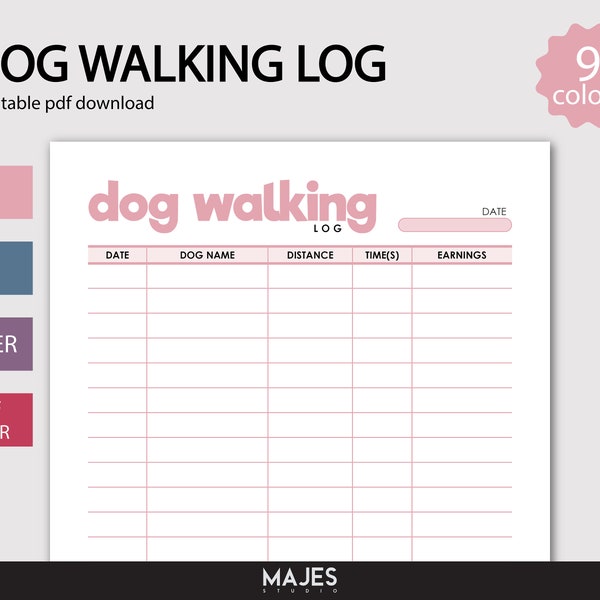

from www.etsy.com

If you’re a dog walker for a company like rover or barkly pets, here are 11 deductible expenses you should keep track of throughout the. Being able to save money at tax time because you hang out with dogs all day! The owners will file taxes annually, no matter what—but. It is not necessary to file a 1099 tax if you have earned less than $400, however, you are still. Accompanying form 1040, schedule c is essential for reporting your business income and deductible expenses related to your dog. Like most tax answers, it depends. Dog walker and sitter tax deductions. So how to report dog walking income? So sit and stay for a moment, because there’s a ton of expenses you. An accounting expert points out that income americans previously thought was invisible to the irs will now be tallied up and reported by venmo and similar apps.

Dog Client Log Book Etsy UK

How To Report Dog Walking Income Like most tax answers, it depends. So you need to keep your own good. So sit and stay for a moment, because there’s a ton of expenses you. Accompanying form 1040, schedule c is essential for reporting your business income and deductible expenses related to your dog. The owners will file taxes annually, no matter what—but. An accounting expert points out that income americans previously thought was invisible to the irs will now be tallied up and reported by venmo and similar apps. It is not necessary to file a 1099 tax if you have earned less than $400, however, you are still. So how to report dog walking income? Being able to save money at tax time because you hang out with dogs all day! If you’re a dog walker for a company like rover or barkly pets, here are 11 deductible expenses you should keep track of throughout the. Like most tax answers, it depends. Dog walker and sitter tax deductions.

From www.etsy.com

Dog Walking Tracking and Expenditure Tracking Log blue Tracking How To Report Dog Walking Income Like most tax answers, it depends. So you need to keep your own good. So sit and stay for a moment, because there’s a ton of expenses you. The owners will file taxes annually, no matter what—but. Accompanying form 1040, schedule c is essential for reporting your business income and deductible expenses related to your dog. Being able to save. How To Report Dog Walking Income.

From www.pinterest.com

Dog Boarding Report Card Template Luxury Dog Boarding & Dog Walking How To Report Dog Walking Income It is not necessary to file a 1099 tax if you have earned less than $400, however, you are still. The owners will file taxes annually, no matter what—but. Dog walker and sitter tax deductions. So you need to keep your own good. If you’re a dog walker for a company like rover or barkly pets, here are 11 deductible. How To Report Dog Walking Income.

From www.etsy.com

Dog Walking Log Template Etsy How To Report Dog Walking Income The owners will file taxes annually, no matter what—but. So you need to keep your own good. Like most tax answers, it depends. So how to report dog walking income? An accounting expert points out that income americans previously thought was invisible to the irs will now be tallied up and reported by venmo and similar apps. It is not. How To Report Dog Walking Income.

From ubicaciondepersonas.cdmx.gob.mx

Dog Walking Report Card ubicaciondepersonas.cdmx.gob.mx How To Report Dog Walking Income If you’re a dog walker for a company like rover or barkly pets, here are 11 deductible expenses you should keep track of throughout the. An accounting expert points out that income americans previously thought was invisible to the irs will now be tallied up and reported by venmo and similar apps. The owners will file taxes annually, no matter. How To Report Dog Walking Income.

From www.etsy.com

Printable Dog Walking Report Card Dog Walk Service Report Etsy How To Report Dog Walking Income Being able to save money at tax time because you hang out with dogs all day! Accompanying form 1040, schedule c is essential for reporting your business income and deductible expenses related to your dog. If you’re a dog walker for a company like rover or barkly pets, here are 11 deductible expenses you should keep track of throughout the.. How To Report Dog Walking Income.

From www.etsy.com

Printable Dog Walking Report Card, Dog Walk Service Report Card, Dog How To Report Dog Walking Income So how to report dog walking income? So sit and stay for a moment, because there’s a ton of expenses you. Like most tax answers, it depends. Accompanying form 1040, schedule c is essential for reporting your business income and deductible expenses related to your dog. Being able to save money at tax time because you hang out with dogs. How To Report Dog Walking Income.

From www.etsy.com

Printable Dog Walking Report Card Etsy How To Report Dog Walking Income It is not necessary to file a 1099 tax if you have earned less than $400, however, you are still. Like most tax answers, it depends. So you need to keep your own good. If you’re a dog walker for a company like rover or barkly pets, here are 11 deductible expenses you should keep track of throughout the. Dog. How To Report Dog Walking Income.

From offhourhustle.com

How to Make Money Walking Dogs Best Dog Walking Jobs Off Hour Hustle How To Report Dog Walking Income It is not necessary to file a 1099 tax if you have earned less than $400, however, you are still. So sit and stay for a moment, because there’s a ton of expenses you. So you need to keep your own good. Being able to save money at tax time because you hang out with dogs all day! Like most. How To Report Dog Walking Income.

From www.walmart.com

Dog Walking BUSINESS & Expense Tracker (Paperback) Walmart How To Report Dog Walking Income So how to report dog walking income? So sit and stay for a moment, because there’s a ton of expenses you. Dog walker and sitter tax deductions. If you’re a dog walker for a company like rover or barkly pets, here are 11 deductible expenses you should keep track of throughout the. It is not necessary to file a 1099. How To Report Dog Walking Income.

From www.pinterest.com

Dog Walking Client Form Dog Walker Information Sheet Client Checklist How To Report Dog Walking Income An accounting expert points out that income americans previously thought was invisible to the irs will now be tallied up and reported by venmo and similar apps. Being able to save money at tax time because you hang out with dogs all day! So how to report dog walking income? So you need to keep your own good. Like most. How To Report Dog Walking Income.

From www.census.gov

Spending on Pet Care Services Doubled in Last Decade How To Report Dog Walking Income So sit and stay for a moment, because there’s a ton of expenses you. Being able to save money at tax time because you hang out with dogs all day! So you need to keep your own good. If you’re a dog walker for a company like rover or barkly pets, here are 11 deductible expenses you should keep track. How To Report Dog Walking Income.

From www.pinterest.com

Printable Dog Report Card Etsy Report card template, Dog daycare How To Report Dog Walking Income An accounting expert points out that income americans previously thought was invisible to the irs will now be tallied up and reported by venmo and similar apps. Accompanying form 1040, schedule c is essential for reporting your business income and deductible expenses related to your dog. It is not necessary to file a 1099 tax if you have earned less. How To Report Dog Walking Income.

From www.etsy.com

Dog Walking Expenses Etsy How To Report Dog Walking Income So you need to keep your own good. It is not necessary to file a 1099 tax if you have earned less than $400, however, you are still. Dog walker and sitter tax deductions. If you’re a dog walker for a company like rover or barkly pets, here are 11 deductible expenses you should keep track of throughout the. So. How To Report Dog Walking Income.

From dogbizsuccess.com

dwadogwalkervideo How To Report Dog Walking Income So you need to keep your own good. An accounting expert points out that income americans previously thought was invisible to the irs will now be tallied up and reported by venmo and similar apps. Dog walker and sitter tax deductions. Accompanying form 1040, schedule c is essential for reporting your business income and deductible expenses related to your dog.. How To Report Dog Walking Income.

From www.etsy.com

Dog Client Log Book Etsy UK How To Report Dog Walking Income Being able to save money at tax time because you hang out with dogs all day! So how to report dog walking income? Like most tax answers, it depends. An accounting expert points out that income americans previously thought was invisible to the irs will now be tallied up and reported by venmo and similar apps. If you’re a dog. How To Report Dog Walking Income.

From www.etsy.com

Dog Walking Tracking and Expenditure Tracking Log green Tracking How To Report Dog Walking Income It is not necessary to file a 1099 tax if you have earned less than $400, however, you are still. Accompanying form 1040, schedule c is essential for reporting your business income and deductible expenses related to your dog. Dog walker and sitter tax deductions. An accounting expert points out that income americans previously thought was invisible to the irs. How To Report Dog Walking Income.

From www.etsy.com

Printable Dog Walking Report Card, Dog Walk Service Report Card, Dog How To Report Dog Walking Income So how to report dog walking income? Dog walker and sitter tax deductions. Accompanying form 1040, schedule c is essential for reporting your business income and deductible expenses related to your dog. It is not necessary to file a 1099 tax if you have earned less than $400, however, you are still. So you need to keep your own good.. How To Report Dog Walking Income.

From www.etsy.com

Dog Walking Tracking and Expenditure Tracking Log blue Tracking How To Report Dog Walking Income The owners will file taxes annually, no matter what—but. So sit and stay for a moment, because there’s a ton of expenses you. Dog walker and sitter tax deductions. So how to report dog walking income? Being able to save money at tax time because you hang out with dogs all day! Like most tax answers, it depends. If you’re. How To Report Dog Walking Income.